This significant impact is due to the complexity of financial transactions, enormous amounts of proprietary and third-party data, increasing fraudulent activity, and the large number of customers financial institutions service. AI in finance is rapidly transforming how banks and other financial institutions perform investment research, engage with customers, and manage fraud. While traditional banking institutions are interested in incorporating new technologies, fintechs are adopting this technology more quickly as they try to catch up with larger institutions. To stay ahead of the game, larger financial institutions are investing heavily, with 77% planning to increase their budgets over the next three years, according to Scale’s 2023 AI Readiness report. Improving the explainability levels of AI applications can contribute to maintaining the level of trust by financial consumers and regulators/supervisors, particularly in critical financial services (FSB, 2017[11]).

Improve decision-making

A valuable research area that should be further explored concerns the incorporation of text-based input data, such as tweets, blogs, and comments, for option price prediction (Jang and Lee 2019). Since derivative pricing is an utterly complicated task, Chen and Wan (2021) suggest studying advanced AI designs that minimise computational costs. Funahashi (2020) recognises a typical human learning process (i.e. recognition by differences) and applies it to the model, significantly simplifying the pricing problem.

Discover content

The use of such techniques can be beneficial for market makers in enhancing the management of their inventory, reducing the cost of their balance sheet. To capture the benefits of these exciting new technologies while controlling https://www.quick-bookkeeping.net/ the risks, companies must invest in their software development and data science capabilities. And they will need to build robust frameworks to manage data quality and model engineering, human–machine interaction, and ethics.

Is finance at risk of AI?

Hence, future contributions may advance our understanding of the implications of these latest developments for finance and other important fields, such as education and health. The use of AI in the cryptocurrency market is in its infancy, and so are the policies regulating it. As the digital currency industry has become increasingly important in the financial world, future research should study the impact of regulations and blockchain progress on the performance of AI techniques applied in this field (Petukhina et al., 2021). Hence, new AI approaches should be developed in order to optimise cryptocurrency portfolios (Burggraf 2021). Additionally, the Hierarchical Risk Parity (HRP) approach, an asset allocation method based on machine learning, represents a powerful risk management tool able to manage the high volatility characterising Bitcoin prices, thereby helping cryptocurrency investors (Burggraf 2021).

The first two decades of the twenty-first century have experienced an unprecedented way of technological progress, which has been driven by advances in the development of cutting-edge digital technologies and applications in Artificial Intelligence (AI). Artificial intelligence is a field of computer science that creates intelligent machines capable of performing cognitive tasks, such as reasoning, learning, taking action and speech recognition, which have been traditionally regarded as human tasks (Frankenfield 2021). AI comprises a broad and rapidly growing number of technologies and fields, and is often regarded as a general-purpose technology, namely a technology that becomes pervasive, improves over time and generates complementary innovation (Bresnahan and Trajtenberg 1995). As a result, it is not surprising that there is no consensus on the way AI is defined (Van Roy et al. 2020). Kavout uses machine learning and quantitative analysis to process huge sets of unstructured data and identify real-time patterns in financial markets.

Cadana, an emerging markets payroll services provider for global hiring platforms, banks $7.1M seed

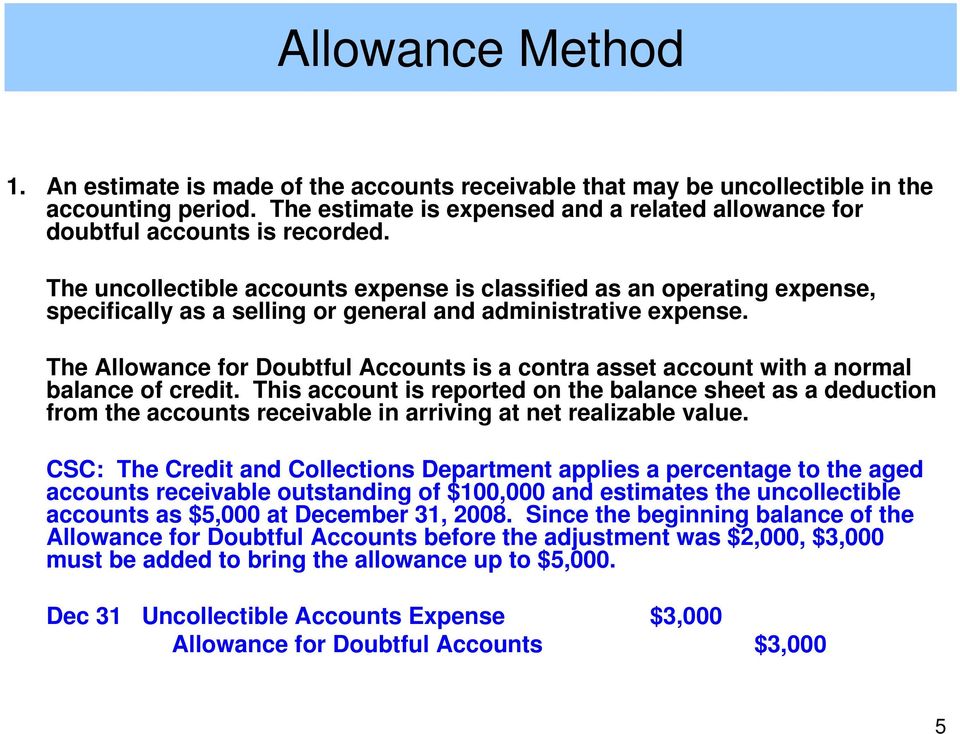

Second, automated financial close processes enable companies to shift employee activity from manual collection, consolidation, and reporting of data to analysis, strategy, and action. Using our own solutions, Oracle closes its books faster than anyone in the S&P 500—just 10 days or roughly half of the time taken by our competitors. This leaves our financial team with more time focused on the future instead of just reporting the past.

Financial institutions that successfully use gen AI have made a concerted push to come up with a fitting, tailored operating model that accounts for the new technology’s nuances and risks, rather than trying to incorporate gen AI into an existing operating model. We have observed that the majority of financial institutions making the most of gen AI are using a more centrally led operating model for the technology, https://www.personal-accounting.org/bookkeeping-101-a-beginners-guide-on-where-to/ even if other parts of the enterprise are more decentralized. The second sub-stream investigates the use of neural networks and traditional methods to forecast stock prices and asset performance. ANNs are preferred to linear models because they capture the non-linear relationships between stock returns and fundamentals and are more sensitive to changes in variables relationships (Kanas 2001; Qi 1999).

To date, there is no commonly accepted practice as to the level of disclosure that should be provided to investors and financial consumers and potential proportionality in such information. Careful design, diligent auditing and testing of ML models can further assist in avoiding potential biases. Inadequately designed and controlled AI/ML models carry a risk of exacerbating or reinforcing existing biases while at the same time making discrimination even harder to observe (Klein, 2020[35]).

This enables more personalized interactions, faster and more accurate customer support, credit scoring refinements and innovative products and services. AI integration in blockchains could in theory support decentralised applications in the DeFi space through use-cases that could increase automation and efficiencies in the provision of certain financial services. Researchers suggest that, in the future, AI could also be integrated for forecasting and automating in ‘self-learned’ smart contracts, similar to models applying reinforcement learning AI techniques (Almasoud et al., 2020[27]). In other words, AI can be used to extract and process information of real-time systems and feed such information into smart contracts. As in other blockchain-based financial applications, the deployment of AI in DeFi augments the capabilities of the DLT use-case by providing additional functionalities; however, it is not expected to radically affect any of the business models involved in DeFi applications. AI tools and big data are augmenting the capabilities of traders to perform sentiment analysis so as to identify themes, trends, patterns in data and trading signals based on which they devise trading strategies.

Nevertheless, the introduction of AI in DLT-based networks does not necessarily resolve the ‘garbage in, garbage out’ conundrum as the problem of poor quality or inadequate data inputs is a challenge observed equally in AI-based applications. The use of investing activities do not include the is gaining traction as organizations realize the advantages of using algorithms to streamline and improve the accuracy of financial tasks. Step through use cases that examine how AI can be used to minimize financial risk, maximize financial returns, optimize venture capital funding by connecting entrepreneurs to the right investors; and more.

- Evidence based on a survey conducted in UK banks suggest that around 35% of banks experienced a negative impact on ML model performance during the pandemic (Bholat, Gharbawi and Thew, 2020[50]).

- Here are a few examples of companies using AI to learn from customers and create a better banking experience.

- For example, when observed data is not provided by the customer (e.g. geolocation data or credit card transaction data) notification and consent protections are difficult to implement.

Mastercard’s strategic application of AI serves as a powerful example for other organizations looking to harness the potential of this technology. Through a well-defined governance framework, rigorous review processes, and a commitment to ethical practices, Mastercard ensures that its AI initiatives deliver significant value while upholding the highest standards of responsibility and integrity. As AI continues to evolve, Mastercard’s proactive and strategic approach will undoubtedly keep it at the cutting edge of innovation in the financial industry. The company’s governance processes ensure that all AI applications align with its core principles and regulatory requirements.

Operational challenges relating to compatibility and interoperability of conventional infrastructure with DLT-based one and AI technologies remain to be resolved for such applications to come to life. In particular, AI techniques such as deep learning require significant amounts of computational resources, which may pose an obstacle to performing well on the Blockchain (Hackernoon, 2020[29]). It has been argued that at this stage of development of the infrastructure, storing data off chain would be a better option for real time recommendation engines to prevent latency and reduce costs (Almasoud et al., 2020[27]). Challenges also exist with regards to the legal status of smart contracts, as these are still not considered to be legal contracts in most jurisdictions (OECD, 2020[25]). Until it is clarified whether contract law applies to smart contracts, enforceability and financial protection issues will persist.

Organisations and individuals developing, deploying or operating AI systems should be held accountable for their proper functioning (OECD, 2019[52]). Importantly, intended outcomes for consumers would need to be incorporated in any governance framework, together with an assessment of whether and how such outcomes are reached using AI technologies. In spite of the dynamic nature of AI models and their evolution through learning from new data, they may not be able to perform under idiosyncratic one-time events not reflected in the data used to train the model, such as the COVID-19 pandemic. Evidence based on a survey conducted in UK banks suggest that around 35% of banks experienced a negative impact on ML model performance during the pandemic (Bholat, Gharbawi and Thew, 2020[50]). This is likely because the pandemic has created major movements in macroeconomic variables, such as rising unemployment and mortgage forbearance, which required ML (as well as traditional) models to be recalibrated.